Press & Publications

Unraveling B2B2C GTM Challenges in Insurance

As B2C acquisition costs soar, B2B2C partnerships are emerging as a strategic GTM/growth lever for insurers and insurtechs.

But success hinges on execution.

From co-selling confusion to misaligned incentives, this piece explores why many partnerships stall, and what GTM leaders must do to unlock scalable, cost-efficient growth through distribution.

Embedded Insurance: Challenges and Opportunities

Life and supplemental health insurance face unique challenges in today’s digital age—complexity, long-term commitment, and lack of use-case specificity. Embedded insurance offers a breakthrough, integrating these products into digital platforms to expand reach, lower acquisition costs, and deliver tailored solutions. For insurance leaders, it’s not just a trend—it’s a strategic shift redefining distribution and consumer engagement.

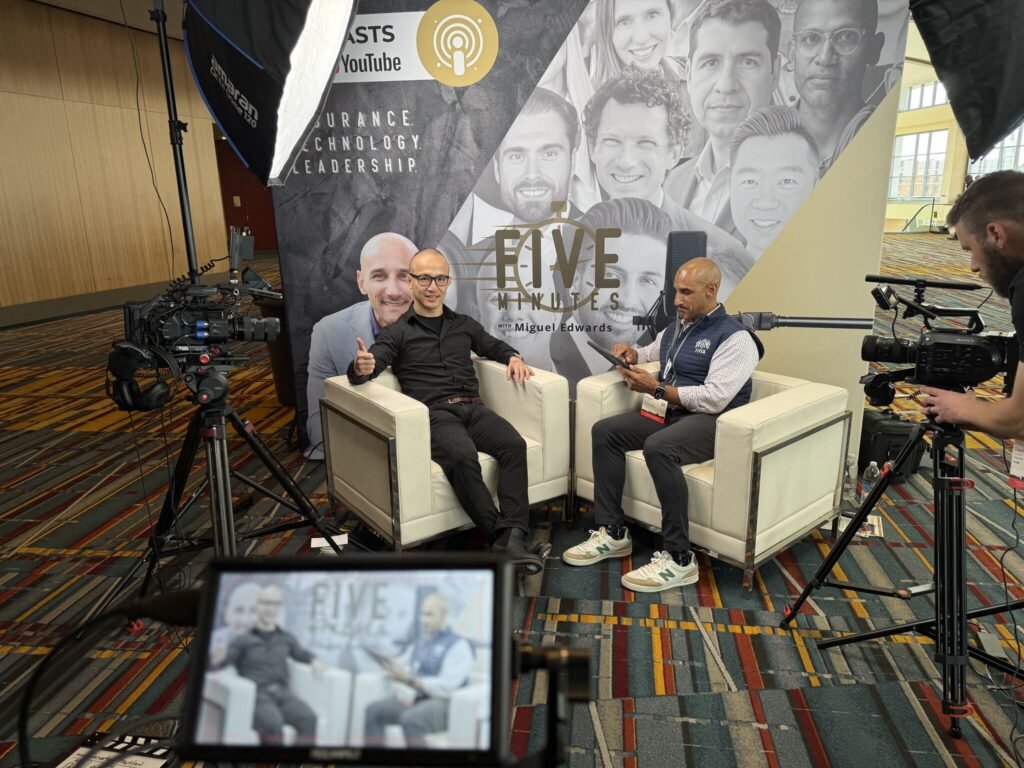

Society of Actuaries Podcasts: Navigating the Shifting Landscape of Partnerships

How are partnerships in life insurance driving growth and innovation beyond distribution? How can strategic alliances help insurers reach new customers and lower acquisition costs? What makes partnerships a powerful tool for creating seamless, trust-based customer experiences? As embedded insurance and alternative channels grow, how will partnerships reshape the future of life insurance?

Tune in this episode to explore the answers!

Underinsured Members? Embedded Tech to the Rescue

Americans are chronically underinsured because insurance feels confusing, inconvenient, and disconnected from daily life. The article shows how embedding simple, trusted protection inside member-first ecosystems creates real value: clearer guidance, easier access, and meaningful financial security. These same principles anchor Member Legacy, designed to deliver protection that feels relevant, effortless, and genuinely member-benefiting.

InsureThink: The rise of embedded insurance

Embedded insurance is rapidly transforming life insurance distribution, using digital integration and APIs to deliver simple, accessible protection through trusted platforms. While underwriting complexity slows adoption, data-driven partnerships and embedded enablers are closing the gaps. The result: lower acquisition costs, broader reach, and seamless, consumer-centric experiences that outperform traditional channels.

Ensuring Fairness in Life Insurance Underwriting: A Distribution-Side Perspective

Life insurers are embracing data, but hidden biases inside product recommendation models, third-party scores, and fragmented carrier-distributor pipelines are quietly shaping who gets approved and who gets left out. This panel breaks down where bias really comes from, why it matters commercially, and what the industry must fix next.

Why Selling One Policy Can Change an Actuary’s Entire Career

Hot take: If you want real career progression as an actuary, sell one policy. Nothing accelerates your growth more than hearing directly from customers. It exposes the blind spots no model or rotation will ever teach and gives you the cross-functional fluency that industry leaders share.